- About Us

- Solutions

- Industries

- Case Studies

- Resources

- Contact Us

Plant-Based Food and Beverages Alternatives: A Revolutionary Trend in the Food-Tech Industry

The global food and beverage industry is currently experiencing an exemplary level of technological disruption, propelled by the profound growth of the trending plant-based food and beverage alternatives. Plant-based food and beverages products use the biomimicry approach to replicate the taste and texture of the animal-derived product. Health and wellness, food safety, environmental sustainability, animal welfare, adopting restrictive diets due to preferred lifestyle choices, and increasing population of flexitarian consumers are the key factors propelling the growth of plant-based food and beverage alternative products globally. According to the analysis by BIS Research, the plant-based food and beverages alternatives market is expected to grow at a noteworthy CAGR of 13.82% during the forecast period from 2019 to 2024.

Demand for plant-based food and beverage products is currently evolving in the form of plant-based dairy, plant-based meat, and others (plant-based eggs, egg replacers, creamers, and spreads). These products are derived from different sources of protein, such as soy, pea, almond, corn, wheat, flaxseeds, and others.

Following are the key factors leading to the growth of the plant-based food and beverages industry: -

Companies Attracting Huge Investments in the Plant-Based Food and Beverages Industry

The plant-based products industry is observing increased participation of disruptor companies that are launching innovative products into the market to meet the escalating consumers’ demand for healthy and sustainable food options. Food giants such as Tyson Foods, Perdue Farms, Smithfield Foods, DANONE, and Nestle, along with a different set of companies such as Walmart, IKEA, and Marks and Spencer, are investing significantly in the plant-based food and beverages alternatives market. These companies are actively partnering with retail chains to increase the global reach of their products.

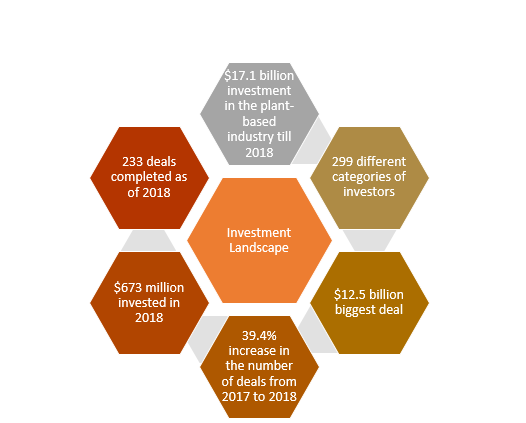

Plant-based meat companies have received significant investment rounds from venture capital investors since 2017. For instance, in February 2020, Alpha foods received series A capital funding of $28 million. Additionally, in January 2020, the plant-based beverage company, Califia Farms received $225 million funding by the Qatar investment authority. These are some of the latest investments happening at a rapid pace in the plant-based food and beverages industry at a rapid pace. The overall investment scenario of plant-based food and beverages alternatives market is depicted in the following figure:

Source: Secondary Sources and BIS Research Analysis

Innovative Product Launches

The plant-based food and beverages alternatives market comprises major companies providing food types such as plant-based burgers, plant-based sausages, plant-based cheeses, plant-based dips, plant-based creams, plant-based yogurts, and plant-based scrambled eggs.

Major players operating in the plant-based food and beverages alternatives industry include companies such as Daiya Foods, Blue Diamond Growers, Impossible Foods, Beyond Meat, Inc., Quorn Foods, Tyson Foods, Conagra Brands, Inc., Amy’s Kitchen, and Blue Diamond Growers.

The emerging strategies and developments in the plant-based food and beverages market are surging in the form of product launches and developments. For instance, in February 2020, Ripple Foods launched its line of plant-based dairy-free ice cream. In January 2020, Impossible Foods, the brand behind the popular Impossible Burger 2.0, unveiled plant-based pork and sausage at the CES 2020, in Las Vegas. Additionally, in May 2019, Danone S.A. had launched low-calorie dairy-free vegan ice cream in three flavors. Major food companies such as Nestle SA and Conagra Brands Inc. are making their own plant-based burgers, too.

Starbucks and Erbert & Gerbert's are the latest companies set to join the plant-based food rage. In January 2020, they have introduced more products to their menu that recognizes the shift toward healthier food options. Additionally, America’s plant-based beverage brand, Silk, in January 2020, added DHA Omega-3 plant-based beverage to the list of its products. It is a unique blend of oat milk, almond milk, and pea protein.

Plant-based food and beverages alternatives market is growing over time, compelling companies to come up with collaborative strategies in order to sustain the intensely competitive market. For instance, in January 2020, Nestlé formed a partnership with two Canadian plant-based food companies Burcans NutraScience and Merit Functional Foods. This partnership is aimed to help Nestle to accelerate the development of the company’s line of meat and dairy alternatives, which are healthy and eco-friendly.

Popular Adopters of the Plant-Based Diet Further Forging Growth of the Industry

Several athletes have also realized the benefits derived from a plant-based diet. The tennis athlete Novak Djokovic who won the Wimbledon finals recently revealed that plant-based and gluten-free foods such as green-juices powered him through Wimbledon. The tennis legend herself, Serena Williams, also believes in eating a vegan diet. In December 2017, she invested in Daily Harvest, a U.S.-based frozen plant-based foods company. Also, in August 2017, Bill Gates and Li Ka-Shing invested in Impossible Foods, a U.S.-based start-up, for creating a “bleeding” plant-based burger (because of its signature blood-red color).

Comprehensive Regional Landscape

North America gained a major portion of the plant-based food and beverages market share in terms of the revenue generated in 2018, followed by the Europe region. The region has been experiencing a rapid growth rate in the particular industry the past few years, owing to the increasing environmental concerns, growing vegan population, growing preference for meat alternatives, increasing demand for healthy and nutritional products, and the health and wellness trend being followed in region.

Asia-Pacific is an emerging region in the plant-based food and beverages industry. The region is inclusive of one of the largest vegetarian populations in the world, which is expected to create several opportunities for companies in the plant-based food and beverages alternatives industry. The opportunity for growth for plant-based food and beverage products is increasing massively, as the demand for meat continues to increase. The companies that are entering the region are focusing on developing their brand capability to enhance their presence across the region.

Food of the Future

The plant-based food and beverages are in quite a primary stage of their life cycle currently; however, with the exponential level of new product developments and ongoing investments, the demand for plant-based food and beverages is likely to increase manifold. The massive benefits derived from the consumption of plant-based products promise rapid growth of the plant-based food and beverages alternatives market and opportunities for the market players thereon.

Get DeepTech Insights in your Mailbox!

Popular Posts

- Mycelium: A New Age Packaging Material

- Eco-Friendly Fabrics: The Rise of Castor Oil Biopolymers in the Textile Industry

- World’s First Single Piece 3D-Printed Rocket Engine is Ready to Thrust its First Flight

- Precision Optics in the Next Decade: What to Expect and What's Possible

- Floating Data Center Market: Trends, Growth Drivers, and Future Prospects

Recent Posts

- Invest in Carbon Credits Market for AFOLU: Growth and Future Outlook

- Why Invest in Space-Based RF & Microwave Technology Market ?

- Aplastic Anemia Market Report 2026: Growth Trends, Pipeline Insights, and Investment Opportunities

- Autonomous Vehicle Simulation Solutions Market: Competitive Landscape & Forecast

- Lightweight Rooftop Solar PV Market: Competitive Landscape & Insights

Posts by Topic

- Healthcare & Medical (83)

- Market Research Report (40)

- Agriculture & Food Tech (29)

- Advanced Materials & Chemicals (27)

- Automotive (27)

- Covid-19 (24)

- Aerospace defense (23)

- Robotics & UAV (23)

- Coronavirus (22)

- 3D Printing (20)

- Digital Technology (15)

- Electronics & Semiconductor (15)

- novel covid-19 (14)

- Electronic Cigarette (11)

- Precision Agriculture (11)

- novel coronavirus (10)

- Security & Surveillance (9)

- Artificial Intelligence (8)

- Webinar (8)

- corona virus (8)

- 3D Printing Market (7)

- BIS Research (7)

- BIS Research Webinar (6)

- Blockchain technology (6)

- Building Technologies & HVAC (6)

- Healthcare (6)

- Market Trends (6)

- UAV (6)

- precision agriculture market (6)

- Energy and sustainability (5)

- Waste Management & Envir Tech (5)

- covid19 (5)

- e-cigarette (5)

- electronic cigarette (5)

- precision medicine market (5)

- Agriculture (4)

- Automotive Cybersecurity (4)

- Computed Tomography (4)

- Electric Vehicles (4)

- Precision Farming (4)

- Unmanned Aerial Vehicles (4)

- precision medicine (4)

- precision medicine report (4)

- 3D Printer (3)

- 3D Printing Technology (3)

- Augmented Reality and Virtual Reality Market (3)

- Big Data (3)

- Biomanufacturing 4.0 (3)

- Counter-UAS Technology (3)

- Drones (3)

- EV Batteries (3)

- EV Battery Market (3)

- Healthcare Industry (3)

- Internet of Things (3)

- IoT in Agriculture Market (3)

- Market (3)

- Market Forecast (3)

- Plastics (3)

- SpaceTech (3)

- Surgical Procedure Volume Database (3)

- Surgical Robotics Market (3)

- automotive cybersecurity market (3)

- bis research blog (3)

- e liquid market forecast (3)

- e-cigarette market (3)

- electronic cigarette market (3)

- healthcare sector (3)

- market research report (3)

- noval corona virus (3)

- precision farming market (3)

- precision medicine industry (3)

- space and aerospace (3)

- surgical robotics market growth (3)

- telemedicine (3)

- uav market forecast (3)

- 2016-2021 (2)

- 3D Printing Application Market (2)

- 3D Printing Market Analysis (2)

- 3D Printing Material (2)

- 3D Printing Material Market (2)

- 3D Printing Technology Market (2)

- 6G Technology (2)

- ADAS Market (2)

- Advanced Wound Dressing Market (2)

- Advancements in Augmented Reality (2)

- Aerospace (2)

- Agricultural Industry (2)

- Agricultural Sensors (2)

- Agriculture & Food (2)

- Agriculture Dealers Industry (2)

- Agriculture Dealers Market (2)

- Agriculture Drones and Robots Market (2)

- Agriculture Industry (2)

- Agriculture IoT (2)

- Agriculture Technology-as-a-Service Market (2)

- Augmented Reality (2)

- Automotive LiDAR Market (2)

- Automotive LiDAR Market Research (2)

- Automotive Market (2)

- Autonomous Vehicle (2)

- Autonomous Vehicle Market (2)

- Autonomous Vehicle Simulation Solutions Market (2)

- BVLOS drones (2)

- Battery (2)

- Blockchain Technology Market (2)

- CAD Market (2)

- CRISPR Technology Market (2)

- CRISPR Technology Market forecast (2)

- CRISPR Technology Market report (2)

- CRISPR Technology Market share (2)

- CRISPR Technology Market trends (2)

- CRISPR Technology Market value (2)

- CRISPR Technology Marketresearch (2)

- Carbon Negative (2)

- Cell and Gene Therapy (2)

- Cognitive Electronic Warfare System (2)

- Commercial Drones (2)

- Commercial Vehicles (2)

- Computer Aided Design Market (2)

- Consumer Printer (2)

- Crop Production (2)

- Cybersecurity (2)

- Defense Market (2)

- Diagnostic Imaging Market (2)

- Digital Agriculture Marketplace Market (2)

- Digital Technology Market (2)

- Disposable Protective Apparel (2)

- Drone (2)

- ENT Devices Market (2)

- EV Battery Pack Cooling System Industry (2)

- EV Battery Pack Cooling System Market (2)

- EV Battery Pack Cooling System Market Research (2)

- EV Battery industry (2)

- EV Battery report (2)

- Early Multicancer Detection (2)

- Electric Vehicle Battery industry (2)

- Electric Vehicles Battery Market (2)

- Emerging technology (2)

- Food Safety Testing Market (2)

- Food Safety Testing Services Market (2)

- Fuel Cells Market (2)

- Games of Skill Market (2)

- Global Augmented Reality Market (2)

- Global Augmented Reality and Virtual Reality Marke (2)

- Global Automotive Telematics Market (2)

- Global Automotive Telematics Market Report (2)

- Global Beacons Technology Market (2)

- Global Beacons Technology Market Analysis (2)

- Global Beacons Technology Market Analysis and Fore (2)

- Global Beacons Technology Market Forecast (2)

- Global Beacons Technology Market Research (2)

- Global Beacons Technology Market Share (2)

- Global CRISPR Technology Market (2)

- Global Carbon Nanotube Market Report (2)

- Global Carbon Nanotube Market Trends (2)

- Global Continuous Fiber Composites Market (2)

- Global Drone Market (2)

- Global EV Battery Market (2)

- Global Food Safety Testing Market (2)

- Global Food Safety Testing Market Analysis (2)

- Global Food Safety Testing Market Trends (2)

- Global Food Safety Testing Market growth (2)

- Global Industrial Microbiology industry analysis (2)

- Global Industrial Microbiology industry report (2)

- Global Intelligent Lighting Controls Market (2)

- Global Liquid Biopsy End User Market (2)

- Global Liquid Biopsy Market Share (2)

- Global Markets and Technologies for Food Safety (2)

- Global Medical Image Analytics Market (2)

- Global Next Generation Sequencing (2)

- Global Next Generation Sequencing Market Share (2)

- Global SLAM Technology Market (2)

- Global SLAM Technology Market Size (2)

- Global SLAM Technology Market Size by Country (2)

- Global SLAM Technology Market by Region (2)

- Global SLAM Technology Market for Robot (2)

- Global SLAM Technology Market for Robots by Commer (2)

- Global SLAM Technology Market for Robots by Househ (2)

- Global SLAM Technology Market for UAV (2)

- Global SLAM Technology Market forecast (2)

- Global SLAM Technology Market growth (2)

- Global SLAM Technology Market report (2)

- Global SLAM Technology Market research (2)

- Global SLAM Technology Market share (2)

- Global SLAM Technology Market trends (2)

- Global Surgical Robotics Market (2)

- Global UAV Sense and Avoid Systems Market (2)

- Global UAV market (2)

- Global Video Surveillance Market (2)

- Global iBeacon Market Size (2)

- Global liquid biopsy market (2)

- Global small caliber ammunition market (2)

- HVACR (2)

- HVACR Market (2)

- Healthcare Robots Trends (2)

- Heating Equipment Market (2)

- IOT in Oil and Gas (2)

- IVD Market (2)

- In-Space Economy (2)

- In-Vitro Fertilization Market (2)

- Indoor Vertical Farming (2)

- Industrial IoT Market (2)

- Industrial Microbiology Market (2)

- Industrial Microbiology Market Report (2)

- Industrial Microbiology Market forecast (2)

- Industrial Microbiology Market share (2)

- Industrial Microbiology Market size (2)

- Industrial Microbiology Market trends (2)

- Industrial microbiology (2)

- IoT (2)

- LED (2)

- LED Market (2)

- LiDAR Market (2)

- Lightweight Rooftop Solar PV Industry (2)

- Lightweight Rooftop Solar PV Market (2)

- Lightweight Rooftop Solar PV Report (2)

- Liquid Biopsy (2)

- Liquid Biopsy Market Size (2)

- Liquid Cooling Industry for Stationary BESS (2)

- Liquid Cooling Market for Stationary BESS (2)

- Liquid Cooling Report for Stationary BESS (2)

- Liquid biopsy market (2)

- Lithium-Ion Batteries (2)

- LoRaWAN (2)

- Low-Carbon Aluminum Industry (2)

- Low-Carbon Aluminum Market (2)

- Low-Carbon Aluminum Report (2)

- Machine learning (2)

- Market Growth (2)

- Medical Imaging Market (2)

- Mental Health (2)

- Microbiome Modulators Market (2)

- NGS Sample Preparation Market (2)

- NIPT (2)

- Nanocoatings Market (2)

- Neurostimulation Devices Market Share (2)

- Neurostimulation Devices Market growth (2)

- Neurostimulation Devices market (2)

- Non-Invasive Prenatal Testing Market (2)

- Powered Agriculture Equipment Market (2)

- Precision medicine market growth (2)

- Precision medicine market report (2)

- Precision medicine market size (2)

- Precision medicine market trends (2)

- Prefilled Syringes Market (2)

- Radiation Dose Management (2)

- Remote Drone Identification System Market Size (2)

- Robotics and Imaging (2)

- SLAM Technology for Augmented Reality (2)

- SLAM Technology for Autonomous Vehicles (2)

- SLAM Technology for Robots (2)

- SLAM Technology for UAV (2)

- SLV Market (2)

- Satellite Spectrum Monitoring (2)

- Satellite Spectrum Monitoring Market (2)

- Satellites (2)

- Sensor (2)

- Small Launch Vehicle Market (2)

- Small Modular Reactor Market (2)

- Small Satellite Market Forecast (2)

- Smart Lighting Market (2)

- Surgical Robotics (2)

- Surgical Robotics Market trends (2)

- Surgical Robotics industry (2)

- Surgical Robotics report (2)

- Sustainable Future (2)

- Sustainable Space (2)

- Switchgear Monitoring System Market (2)

- Switchgear Monitoring System Market size (2)

- UAVs (2)

- UK E cigarette market (2)

- Unmanned Aerial Vehicles Market (2)

- VTOL Aircraft Market (2)

- Vertical Farming (2)

- Wearable Technology (2)

- Wound Cleanser Products Market (2)

- advanced electronic materials (2)

- anti money laundering software market size (2)

- applications of crispr technology (2)

- automotive sector (2)

- beacon market research (2)

- beacon market size (2)

- beacon marketing solutions (2)

- beacon technology (2)

- beacon technology market research (2)

- beacon technology market size (2)

- biometric identification market (2)

- bluetooth beacon technology (2)

- cancer treatment (2)

- cannabis market in North America (2)

- corona (2)

- crispr cas technology (2)

- crispr cas9 technology (2)

- crispr gene technology (2)

- crispr news (2)

- crispr technology (2)

- crispr technology companies (2)

- data centers (2)

- data mining (2)

- defense industry (2)

- defense outlook (2)

- drone industry (2)

- drones market research (2)

- drug discovery (2)

- e cigarette market reports (2)

- e liquid market study (2)

- e vapor (2)

- eddystone beacon technology market size (2)

- electric propulsion (2)

- electric vehicle (2)

- electric vehicle industry (2)

- electronic cigarette market report (2)

- european e liquid market (2)

- european e liquid market reports (2)

- fleet management market (2)

- food pathogen testing market size (2)

- food safety market size (2)

- global food safety testing market size (2)

- global healthcare robotics market (2)

- global positioning systems (2)

- green hydrogen technology (2)

- healthcare trends (2)

- high acuity information systems (2)

- hvac market forecast (2)

- hvac market report (2)

- ibeacon for real estate (2)

- iot security market analysis (2)

- iot security market forecast (2)

- liquid biopsy market report (2)

- market size (2)

- medical imaging (2)

- medical robotics industry growth (2)

- micro mobility market (2)

- minimally invasive surgical systems market (2)

- next generation sequencing market (2)

- novel corona virus (2)

- pathogen testing market (2)

- pollution (2)

- precision agriculture industry (2)

- precision agriculture report (2)

- robotic surgery market (2)

- robotic surgery market size (2)

- satellite imaging (2)

- small satellite launch market (2)

- space technology (2)

- stratasys (2)

- surgical procedure volume data (2)

- surgical robots market (2)

- uav market report (2)

- unmanned aerial vehicle market (2)

- vape (2)

- vapor (2)

- ventilators (2)

- video surveillance market forecast (2)

- wearable electronics (2)

- what is crispr technology (2)

- world environment day (2)

- 2019 AI Trends (1)

- 3D Cell Culture (1)

- 3D Printed Gown (1)

- 3D Printing Market for Aerospace (1)

- 3D Printing Market for Aerospace Industry by Mater (1)

- 3D Printing Market for Aerospace Industry by Regio (1)

- 3D Printing Market for Automotive (1)

- 3D Printing Market for Automotive Industry by Mate (1)

- 3D Printing Market for Automotive Industry by Regi (1)

- 3D Printing Material Market Forecast (1)

- 3D Printing Materials Market (1)

- 3D Printing Materials Market Research (1)

- 3D Printing Plastic Market (1)

- 3D Printing Plastic and Photopolymer Material Mark (1)

- 3D Printing Software (1)

- 3D Printing Software and Services Market (1)

- 3D Printing Technologies (1)

- 3D Printing Technology Industry (1)

- 3D Printing Technology report (1)

- 3D Printing in Food Industry (1)

- 3D Protein Structure (1)

- 3D printing in Fashion (1)

- 3D printing market report (1)

- 3D printing materials Aerospace (1)

- 3D printing materials Automotive (1)

- 3D printing or additive manufacturing (1)

- 3D printing software market (1)

- 3D printing technology aerospace (1)

- 3D printing technology automotive (1)

- 3D-Printed Rocket Engine (1)

- 3DP (1)

- 3DP Market (1)

- 3DP Meterials Market (1)

- 3DP Technology (1)

- 3d (1)

- 3d Printer in Medical (1)

- 3d bioprinting market (1)

- 3d bioprinting market report (1)

- 3d bioprinting market size (1)

- 3d printed gun (1)

- 3d printing in automotive (1)

- 3d printing in dental (1)

- 3d printing market research (1)

- 3d printing market share (1)

- 3d printing market size (1)

- 3d printing market trends (1)

- 3d printing use case (1)

- 4d printing (1)

- 5G Industry (1)

- 5G Infrastructure (1)

- 5G Infrastructure Industry (1)

- 5G Infrastructure Market (1)

- 5G Infrastructure Market Analysis (1)

- 5G Infrastructure Market By Spectrum Type (1)

- 5G Infrastructure Market Forecast (1)

- 5G Infrastructure Market Growth (1)

- 5G Infrastructure Market Research Report (1)

- 5G Infrastructure Market Share (1)

- 5G Infrastructure Market Trends (1)

- 5G Infrastructure Market by Application (1)

- 5G Infrastructure Market by Region (1)

- 5G Infrastructure Market key[players (1)

- 5G Infrastructure Report (1)

- 5G Market (1)

- 5G Network Industry (1)

- 5G Network Market (1)

- 5G Network Market Study (1)

- 5G Network Report (1)

- 5G Report (1)

- 5G Satellite (1)

- 5G Technology Forecast (1)

- 5G Technology Industry (1)

- 5G Technology Market (1)

- 5G Technology Market Research (1)

- 5G Technology Market Study (1)

- 5G Technology Market Trends (1)

- 5G Technology Report (1)

- 5G Technology Share (1)

- 5G technologies (1)

- 5GNetwork Market Research (1)

- 5g Market Share (1)

- 5g Market Share Analysis (1)

- 5g Market Study (1)

- 5g Market Trends (1)

- 5g market forecast (1)

- ABS (1)

- ADAS (1)

- ADAS Commercial Vehicles Market (1)

- ADAS Commercial Vehicles Market Forecast (1)

- ADAS Market Size by Commercial Vehicles Market (1)

- ADAS Vehicle Market (1)

- ADAS market size (1)

- AGEYE (1)

- AGV (1)

- AGV Market (1)

- AGV Market Analysis (1)

- AGV Market Outlook (1)

- AGV Market Study (1)

- AI Applications (1)

- AI Healthcare (1)

- AI Market Reports (1)

- AI in 2019 (1)

- AI in Healthcare Market (1)

- AI in Healthcare Robotics (1)

- AI in Medical Imaging (1)

- AI in Operating Room Market (1)

- AI in cybersecurity (1)

- AI systems (1)

- AI-Enabled Medical Imaging (1)

- AI-Enabled Medical Imaging Solutions Market (1)

- AI-Powered Cybersecurity (1)

- AI-based ECG technology (1)

- AIP System (1)

- AIP systems for submarines (1)

- AIP technology (1)

- APAC Air Purifier Market (1)

- APAC Air Purifier Market analysis (1)

- APAC Air Purifier Market growth (1)

- APAC Air Purifier Market report (1)

- APAC Air Purifier Market research report (1)

- APAC Air Purifier Market share (1)

- APAC Air Purifier industry analysis (1)

- APAC Air Purifiers Player Share Analysis (1)

- APAC Autonomous Vehicle Market (1)

- APAC E-cigarette Market (1)

- APAC E-cigarette Market Forecast (1)

- APAC E-cigarette Market Survey (1)

- APAC E-cigarette Market Trends (1)

- APAC E-cigarette Report (1)

- APAC E-liquid Market (1)

- APAC E-liquid Market Forecast (1)

- APAC E-liquid Market Report (1)

- APAC E-liquid Market Size (1)

- APAC E-liquid Market Study (1)

- APAC Fiber Optic Cable Industry (1)

- APAC Fiber Optic Cable Market (1)

- APAC Fiber Optic Cable Report (1)

- APAC Precision Farming Market (1)

- APAC Space Carbon Composite Fiber Market (1)

- APAC Space Carbon Fiber Composite Industry (1)

- APAC Space Carbon Fiber Composite Report (1)

- APAC TJA Systems Market (1)

- APAC Traffic Jam Assist Systems Market (1)

- APAC microgrid market (1)

- AR (1)

- AR & MR Market Research (1)

- AR Market (1)

- AR and VR Market (1)

- AVping (1)

- Accelermeter (1)

- Acid Metal Complex Dyes Industry (1)

- Acid Metal Complex Dyes Market (1)

- Acid Metal Complex Dyes Report (1)

- Acquistion (1)

- Actuators Market (1)

- Actuators Market Analysis (1)

- Adaptive Lighting Market (1)

- Adaptive Lighting Market Analysis (1)

- Adaptive Lighting Systems (1)

- Added by Bhavya (1)

- Additive manufacturing application market (1)

- Addressable Market Size and Growth Potential (1)

- Adjuvant agriculture (1)

- Advance Energy Storage Market (1)

- Advance Energy Storage Market Trends (1)

- Advanced Dental Digital Solutions Market (1)

- Advanced Dental Robotics Solutions Market (1)

- Advanced Driver Assistance System Market (1)

- Advanced Energy Storage Market Report (1)

- Advanced Energy Storage Market Study (1)

- Advanced Message Queuing Protocol (1)

- Advanced Space Composites Industry (1)

- Advanced Space Composites Market (1)

- Advanced Space Composites Report (1)

- Advanced Traffic Management System (1)

- Advanced Transportation Pricing System (1)

- Advanced Traveler Information System (1)

- Advanced Wound Care Market Analysis (1)

- Advanced Wound Care Market Report (1)

- Advanced Wound Care Market Size (1)

- Advanced Wound Care Market Study (1)

- Advanced Wound Care Market Survey (1)

- Advanced Wound Dressing Industry (1)

- Advanced Wound Dressing Report (1)

- Advanced directed energy weapons (1)

- Advanced propane dehydrogenation (1)

- Advances in UAV Communications (1)

- Advancing Precision Medicine (1)

- AeroFarms (1)

- Aeroponics (1)

- Aerospace 3D Printing Industry (1)

- Aerospace 3D Printing Market (1)

- Aerospace 3D Printing Market Forecast (1)

- Aerospace 3D Printing Market Share (1)

- Aerospace 3D Printing Market Trends (1)

- Aerospace 3D Printing Report (1)

- Agnikul Cosmos (1)

- Agri-Drones Market (1)

- AgriDigital (1)

- Agribusinesses (1)

- Agricultural Films Market (1)

- Agricultural Films Market Research Forecast (1)

- Agricultural Films Market Research Report (1)

- Agricultural Films Market Share (1)

- Agricultural Films Market Size (1)

- Agricultural Films Market forecast (1)

- Agricultural Robots Market (1)

- Agricultural Robots Market Analysis (1)

- Agricultural Robots Market Research (1)

- Agricultural Robots Market Trends (1)

- Agricultural Sensors Market (1)

- Agricultural Sprayers Industry (1)

- Agricultural Sprayers Market (1)

- Agricultural Sprayers Report (1)

- Agricultural Tractor Industry (1)

- Agricultural Tractor Market (1)

- Agricultural Tractor Report (1)

- Agricultural adjuvants market (1)

- Agriculture Autonomous Retrofit Industry (1)

- Agriculture Autonomous Retrofit Market (1)

- Agriculture Autonomous Retrofit Report (1)

- Agriculture Autonomous Robots Industry (1)

- Agriculture Autonomous Robots Market (1)

- Agriculture Autonomous Robots Market Report (1)

- Agriculture Autonomous Robots Market Size (1)

- Agriculture Carbon Sequestration Industry (1)

- Agriculture Carbon Sequestration Market (1)

- Agriculture Carbon Sequestration Report (1)

- Agriculture Customer Segmentation Industry (1)

- Agriculture Customer Segmentation Market (1)

- Agriculture Customer Segmentation Report (1)

- Agriculture Dealers Market Report (1)

- Agriculture Dealers Report (1)

- Agriculture Drones (1)

- Agriculture Equipment Industry (1)

- Agriculture Imaging Sensor Industry (1)

- Agriculture Imaging Sensor Market (1)

- Agriculture Imaging Sensor Market Report (1)

- Agriculture Internet of Things Technology Market (1)

- Agriculture Market (1)

- Agriculture Market Report (1)

- Agriculture Sensor Technology (1)

- Agriculture Sensors (1)

- Agriculture Technology-as-a-Service (1)

- Agriculture Tractor Market (1)

- Agriculture technologies (1)

- Agriculture technology (1)

- Agriculture technology Market (1)

- Agrigenomics Market (1)

- Agritech (1)

- Air Cooling (1)

- Air Purifier Market (1)

- Air Purifier Market report (1)

- Airborne LiDAR Services Market (1)

- Airborne LiDAR System Market (1)

- Airborne LiDAR System Market forecast (1)

- Airborne LiDAR System Market gorwth (1)

- Airborne LiDAR System Market report (1)

- Airborne LiDAR System Market scop (1)

- Airborne LiDAR System Market share (1)

- Airborne LiDAR System Market size (1)

- Airborne LiDAR System Market trends (1)

- Airborne LiDAR System Market value (1)

- Aircraft Landing Gear Market Forecast (1)

- Aircraft Landing Gear Market Research (1)

- Algae Biofuel Industry (1)

- Algae Biofuel Market (1)

- Algae Biofuel Report (1)

- Alkaline Water Electrolysis (1)

- Ambulatory Centers (1)

- Ambulatory surgery centers (1)

- America (1)

- America HVACR Market (1)

- America HVACR Market Research (1)

- Americas HVACR Market (1)

- Americas HVACR Market Report (1)

- Americas Heating Ventilation Air Conditioning and (1)

- Americas Prefabricated Steel Building Market Analy (1)

- Analysis & Forecast (1)

- Analyst brief (1)

- Analysts Note (1)

- Android Auto (1)

- Animal Health Monitoring & Comfort Systems (1)

- Animal genetics (1)

- Anti Fingerprint Industry Analysis (1)

- Anti Fingerprint Market Forecast (1)

- Anti Fingerprint Market Share (1)

- Anti Fingerprint Market Trends (1)

- Anti Fingerprint coatings Industry (1)

- Anti Fingerprint coatings Market (1)

- Anti Fingerprint coatings Report (1)

- Anti Reflective Industry Analysis (1)

- Anti Reflective Market Forecast (1)

- Anti Reflective Market Growth (1)

- Anti Reflective Market Share (1)

- Anti Reflective and Anti Fingerprint Industry (1)

- Anti Reflective and Anti Fingerprint Market (1)

- Anti Reflective and Anti Fingerprint Report (1)

- Anti-Aging Devices Market (1)

- Anti-Aging Devices Market Analysis (1)

- Anti-Aging Devices Market Outlook (1)

- Anti-Aging Devices Market Report (1)

- Anti-Aging Devices Market Share (1)

- Anti-Aging Devices Market Size (1)

- Anti-Aging Devices Market forecast (1)

- Anti-Drone Market (1)

- Anti-Money Laundering Software Market (1)

- Anti-Money Laundering Software market share (1)

- Antibody Conjugate Oligonucleotide market (1)

- Antistatic agents (1)

- Application of Circulating cfDNA (1)

- Aquaponics (1)

- Aquaponics and Hydroponics market forecast (1)

- Aquaponics and Hydroponics market growth (1)

- Aquaponics and Hydroponics market industry analysi (1)

- Aquaponics and Hydroponics market research (1)

- Aquaponics and Hydroponics market share (1)

- Aquaponics and Hydroponics market trend (1)

- Aquaponics and Hydroponics market value (1)

- Aquaponics system market (1)

- Aqueous Zinc Flow Battery Industry (1)

- Aqueous Zinc Flow Battery Market (1)

- Aqueous Zinc Flow Battery Report (1)

- Architecture of Clinical Decision Support System (1)

- Artificial Intelligence Market in Healthcare (1)

- Artificial Intelligence Medical Device Industry (1)

- Artificial Intelligence Medical Device Market (1)

- Artificial Intelligence in Healthcare (1)

- Artificial Intelligence in Healthcare Robotics (1)

- Artificial Intelligence in Medical Imaging (1)

- Artificial Intelligence in Real Time Monitoring (1)

- Artificial Organs Industry Analysis (1)

- Artificial Organs Market (1)

- Artificial Organs Market Forecast (1)

- Artificial Organs Market Growth (1)

- Artificial Organs Market Report (1)

- Artificial Organs Market Research (1)

- Artificial Organs Market Share (1)

- Artificial Organs Market Trends (1)

- Artificial Organs Market by Organ Type (1)

- Artificial Organs Market by Region (1)

- Artificial Organs Market by Technology (1)

- Artificial Organs industry (1)

- Artificial Organs report (1)

- Artillery (1)

- Aseptic Connectors Market (1)

- Aseptic Pharma Processing (1)

- Aseptic Pharma Processing Market (1)

- Asia Pacific E-cigarette Market (1)

- Asia Pacific E-cigarette Market Research (1)

- Asia Pacific E-cigarette Market Study (1)

- Asia Pacific E-liquid Market Research (1)

- Asia Pacific E-liquid Market Trends (1)

- Asia Pacific Indoor Robots Market (1)

- Asia Pacific Indoor Robots Market Size (1)

- Asia Pacific Livestock Monitoring & Management (1)

- Asia-Pacific Air Purifiers Market (1)

- Asia-Pacific Autonomous Vehicle Market (1)

- Asia-Pacific Cell and Gene Therapy Manufacturing (1)

- Asia-Pacific In-Vitro Fertilization Market (1)

- Asia-Pacific In-Vitro Fertilization Market forecas (1)

- Asia-Pacific In-Vitro Fertilization Market share (1)

- Asia-Pacific In-Vitro Fertilization Market size (1)

- Astrocast’s Sat IoT technology (1)

- Augmented Reality Market (1)

- Auto Injectors Market (1)

- Automated Data Logging Tools and Systems Industry (1)

- Automated Data Logging Tools and Systems Market (1)

- Automated Data Logging Tools and Systems Report (1)

- Automated Guided Vehicle Market (1)

- Automated Guided Vehicle Market Growth (1)

- Automated Guided Vehicle Market Research (1)

- Automated Guided Vehicle Market Trends (1)

- Automotive 3D Printing Industry (1)

- Automotive 3D Printing Market (1)

- Automotive 3D Printing Market Forecast (1)

- Automotive 3D Printing Market Share (1)

- Automotive 3D Printing Market Trends (1)

- Automotive 3D Printing Report (1)

- Automotive Actuators Market (1)

- Automotive Actuators Market Forecast (1)

- Automotive Actuators Market Research (1)

- Automotive Adaptive Lighting Market (1)

- Automotive Adaptive Lighting Market Research (1)

- Automotive Aftermarket (1)

- Automotive Aftermarket Analysis (1)

- Automotive Aftermarket Research (1)

- Automotive Aftermarket Study (1)

- Automotive Aftermarket Survey (1)

- Automotive Aftermarket Trends (1)

- Automotive Cybersecurity Threats (1)

- Automotive Fuel Injection Market Forecast (1)

- Automotive Fuel Injection Systems Market Analysis (1)

- Automotive Fuel Injection Systems Market Report (1)

- Automotive Fuel Injection Systems Market Size (1)

- Automotive Fuel Injection Systems Market Trends (1)

- Automotive Infotainment Market (1)

- Automotive Infotainment Systems (1)

- Automotive LiDAR System-on-Chip Industry (1)

- Automotive Lighting Market (1)

- Automotive Lighting Market Forecast (1)

- Automotive Navigation Systems Market forecast (1)

- Automotive Navigation Systems Market growth (1)

- Automotive Navigation Systems Market share (1)

- Automotive Navigation Systems Market trends (1)

- Automotive Radars Market (1)

- Automotive Refinish Coatings Market (1)

- Automotive Refinish Coatings Market report (1)

- Automotive Refinish Coatings Market research repor (1)

- Automotive Sensors (1)

- Automotive Sensors Industry (1)

- Automotive Sensors Market (1)

- Automotive Sensors Market Research (1)

- Automotive Solid State Battery Industry (1)

- Automotive Solid State Battery Market (1)

- Automotive Solid State Battery Market Forecast (1)

- Automotive Solid State Battery Market Growth (1)

- Automotive Solid State Battery Market Size (1)

- Automotive Solid State Battery Market Trends (1)

- Automotive Solid State Battery Market Value (1)

- Automotive Solid State Battery Market by Component (1)

- Automotive Solid State Battery Report (1)

- Automotive Solid State Battery(SSB) Market (1)

- Automotive Technologies (1)

- Automotive Telematics Market (1)

- Automotive Telematics Market Research (1)

- Automotive Telematics Market Size (1)

- Automotive Telematics Market report (1)

- Automotive Thermoelectric Generator Industry (1)

- Automotive Thermoelectric Generator Market (1)

- Automotive Thermoelectric Generator Market by Comp (1)

- Automotive Thermoelectric Generator Market by Mate (1)

- Automotive Thermoelectric Generator Market by Vehi (1)

- Automotive Thermoelectric Generator Report (1)

- Automotive Trends (1)

- Autonomous Delivery Robots (1)

- Autonomous Driving Components Market (1)

- Autonomous Navigation Software Industry (1)

- Autonomous Navigation Software Market (1)

- Autonomous Navigation Software Report (1)

- Autonomous Vehicle Market Penetration (1)

- Autonomous Vehicle Simulation Industry (1)

- Autonomous Vehicle Simulation Market (1)

- Autonomous Vehicle Simulation Report (1)

- Autonomous Vehicle Simulation Solutions Industry (1)

- Autonomous Vehicle Simulation Solutions Report (1)

- Autonomous cars (1)

- Avoid System Market (1)

- BIS Healthcare (1)

- BIS Research Report (1)

- BTMS (1)

- BVLOS Drone Operations (1)

- Ballasts and LED Drivers Market (1)

- Banking Indoor Robots Market Size (1)

- Battery Manufacturing Equipment (1)

- Battery Manufacturing Scrap Recycling Industry (1)

- Battery Manufacturing Scrap Recycling Market (1)

- Battery Manufacturing Scrap Recycling Report (1)

- Battery Swapping (1)

- Battery Swapping Charging Infrastructure Industry (1)

- Battery Swapping Charging Infrastructure Market (1)

- Battery Swapping Charging Infrastructure Report (1)

- Battery Thermal Management (1)

- Battery Thermal Management System Market (1)

- Beacons Technology for real estate (1)

- Bidirectional EV Charger Market (1)

- Bidirectional EV Charger Report (1)

- Big Data in Healthcare Market forecast (1)

- Big Data in Healthcare Market report (1)

- Big Data in Healthcare Market share (1)

- Big Data in Healthcare Market size (1)

- Big Data in Healthcare Market trends (1)

- Big Data in Healthcare Market value (1)

- Big Data on Healthcare (1)

- Big Tobacco (1)

- Big data analytics (1)

- Big data and IoT (1)

- Binders in Battery Industry (1)

- Binders in Battery Market (1)

- Binders in Battery Report (1)

- Bio-Based Cosmetics (1)

- Bio-Based Green Cosmetics (1)

- Biodegradable Plastics Industry (1)

- Biodegradable Plastics Market (1)

- Biodegradable Plastics Report (1)

- Bioelectric Medicine Market (1)

- Biofuels Applications (1)

- Biofuels Forecast (1)

- Biofuels Market (1)

- Biofuels Products (1)

- Biofuels Products Market (1)

- Biofuels Report (1)

- Biofuels Technologies (1)

- Biological Role of cfDNA (1)

- Biologics Drug Development (1)

- Biologics Drug Development Industry (1)

- Biologics Drug Development Market (1)

- Biologics Drug Development Market Forecast (1)

- Biologics Drug Development Market Research (1)

- Biologics Drug Development Market Share (1)

- Biologics Drug Development Market Trends (1)

- Biologics Drug Development Report (1)

- Biologics Drug Discovery Market (1)

- Biologics Drug Forecast (1)

- Biologics Drug Industry (1)

- Biologics Drug Market (1)

- Biologics Drug Report (1)

- Biomarkers (1)

- Biomaterials (1)

- Biomaterials Market (1)

- Biomaterials Market Research (1)

- Biomaterials applications (1)

- Biomaterials forecast (1)

- Biomaterials trends (1)

- Biometric Authentication and Identification Indust (1)

- Biometric Authentication and Identification Market (1)

- Biometric Authentication and Identification Report (1)

- Biometric Sensors (1)

- Biometric Video Surveillance Industry (1)

- Biometric Video Surveillance Market (1)

- Biometric Video Surveillance Report (1)

- Biopharmaceuticals (1)

- Bioprinting Market analysis (1)

- Bioprinting Market by Application (1)

- Bioprinting Market by Technology (1)

- Bioprinting Market keyplayer (1)

- Bioprinting Market share (1)

- Bioprinting Market trends (1)

- Bioprinting Market volume (1)

- Biopsy Devices Industry (1)

- Biopsy Devices Market (1)

- Biopsy Devices Report (1)

- Biorational Market (1)

- Biorational Product Market (1)

- Biorational Product Market Analysis (1)

- Biorational Product Market Research (1)

- Biosensors Market analysis (1)

- Biosensors Market forecast (1)

- Biosensors Market growth (1)

- Biosensors Market share (1)

- Blockchain (1)

- Blockchain Technology Market Analysis (1)

- Blockchain Technology in Financial Services Market (1)

- Blockchain in Agriculture and Food Market (1)

- Blockchain in Energy Market (1)

- Blockchain in Genomics (1)

- Blockchain in Genomics Market (1)

- Blockchain in Healthcare (1)

- Blockchain in Healthcare Market forecast (1)

- Blockchain in Healthcare Market report (1)

- Blockchain in Healthcare Market share (1)

- Blockchain in Healthcare Market trends (1)

- Blockchain in Healthcare Market value (1)

- Blockchain in Healthcare Marketresearch (1)

- Bone Scans (1)

- Brain Disease Modalities and Software Market (1)

- Brain Imaging Modalities Market (1)

- Breaking Barriers in Neurology (1)

- Breast Cancer Screening and Diagnostic Industry (1)

- Brute Force Attack (1)

- Building Energy Management System Market (1)

- Building information modeling (1)

- Business Decisions (1)

- Buy Surgical Procedure Volume Database (1)

- By Communication Infrastructure (1)

- C4ISR Market (1)

- C4ISR Systems (1)

- C4ISR Trends (1)

- CAD (1)

- CAD Industry (1)

- CAD Market Forecast (1)

- CAD Market by Application (1)

- CAD Market by Operating System (1)

- CAD Market by Product Type (1)

- CAD Market by Region (1)

- CAD Market by Technology Type (1)

- CAD Report (1)

- CADx (1)

- CADx Cancer Applications (1)

- CADx Imaging Modalities Market (1)

- CADx Mammography Market (1)

- CADx Market (1)

- CAR T-Cell Therapy (1)

- CDR market (1)

- CES 2015 (1)

- CFC industry analysis (1)

- CFC market for aerospace industry (1)

- CFC market report (1)

- CFC market research (1)

- CFC market size (1)

- CGM (1)

- CGM Market (1)

- CNT (1)

- CNT Market (1)

- CNT Market Forecast (1)

- CNT Market Size (1)

- CNT Market Survey (1)

- COVID-19 Treatment (1)

- COVID-19 diagnostic testing market (1)

- COVID-19 on RNA Sequencing Market (1)

- CRISPR Gene Editing (1)

- CRISPR Gene Editing Market (1)

- CT Market (1)

- Caliber Ammunition market (1)

- Caliber Ammunition market analysis (1)

- Caliber Ammunition market report (1)

- Caliber Ammunition market trends (1)

- Caliber ammunition (1)

- Cancer Diagnostics (1)

- Cancer Immunotherapy Industry (1)

- Cancer Immunotherapy Industry Analysis (1)

- Cancer Immunotherapy Market (1)

- Cancer Immunotherapy Market By Product (1)

- Cancer Immunotherapy Market Forecast (1)

- Cancer Immunotherapy Market Share (1)

- Cancer Immunotherapy Market Size (1)

- Cancer Immunotherapy Market Trends (1)

- Cancer Immunotherapy Market by Region (1)

- Cancer Immunotherapy Market by Therapeutic Indicat (1)

- Cancer Immunotherapy Report (1)

- Cancer biomarkers (1)

- Cancer imaging systems market (1)

- Cancer imaging systems market Analysis (1)

- Cancer imaging systems market report (1)

- Cancer imaging systems market size (1)

- Cancer precision medicine market (1)

- CarPlay (1)

- Carbide Market (1)

- Carbon Credits Industry for AFOLU (1)

- Carbon Credits Industry for Agriculture (1)

- Carbon Credits Market for AFOLU (1)

- Carbon Credits Market for Agriculture (1)

- Carbon Credits Report for AFOLU (1)

- Carbon Credits Report for Agriculture (1)

- Carbon Emissions (1)

- Carbon Farming Industry (1)

- Carbon Farming Market (1)

- Carbon Farming Report (1)

- Carbon Nanotube Market (1)

- Carbon Nanotube Market Growth (1)

- Carbon Nanotube Market Research (1)

- Carbon Nanotube Market Study (1)

- Carbon Neutral Data Center Practices (1)

- Carbon Reduction (1)

- Carbon Removal (1)

- Carbon Removal Technologies (1)

- Carbon di-oxide removal (1)

- Cardiac AI Monitoring and Diagnostics Industry (1)

- Cardiac AI Monitoring and Diagnostics Market (1)

- Cardiac AI Monitoring and Diagnostics Report (1)

- Cardiology Medical Image market (1)

- Cardiovascular Implants (1)

- Carrier Screening Market (1)

- Castor Oil Biopolymers (1)

- Cathode Materials Market (1)

- Cathode Materials Market Growth (1)

- Cathode Materials Market Share Analysis (1)

- Cathode Materials Market analysis (1)

- Cathode Materials Market by Region (1)

- Cathode Materials Market forecast (1)

- Cathode Materials Market trends (1)

- Cell Analysis Industry (1)

- Cell Analysis Market (1)

- Cell Analysis report (1)

- Cell Free DNA Isolation and Extraction Market fore (1)

- Cell Free DNA Isolation and Extraction Market grow (1)

- Cell Free DNA Isolation and Extraction Market repo (1)

- Cell Free DNA Isolation and Extraction Market shar (1)

- Cell Free DNA Isolation and Extraction Market size (1)

- Cell Free DNA Isolation and Extraction Market tren (1)

- Cell and Gene Therapy Development (1)

- Cell and Gene Therapy Manufacturing (1)

- Ceramics (1)

- Chemotherapy (1)

- Chimeric antigen receptor (1)

- China Wire and Cable Industry (1)

- China Wire and Cable Market (1)

- China Wire and Cable Report (1)

- Circular Economy (1)

- Circular Economy Webinar (1)

- Cleaning Robot Market Size (1)

- Climate Smart Agriculture Industry (1)

- Climate Smart Agriculture Market (1)

- Climate Smart Agriculture Market Report (1)

- Climate Smart Agriculture Market Size (1)

- Clinical Decision Support System (1)

- Clinical Genomics Market (1)

- Clinical decision support systems (1)

- Cloud based Global Clinical Decision Support Syste (1)

- Coalition for the Advancement of Precision Agricul (1)

- Coaxial Cable Industry (1)

- Coaxial Cable Market (1)

- Coaxial Cable Report (1)

- Cobots (1)

- Cochlear Implants Industry (1)

- Cochlear Implants Market (1)

- Cochlear Implants Report (1)

- Cognitive Robotic Process Automation Market (1)

- Cognitive Robotic Process Automation for Finance a (1)

- Cognitive Robotic Process Automation for Insurance (1)

- Cognitive Robotic Process Automation for Telecom a (1)

- Collaborative Robot Hardware Market Analysis (1)

- Collaborative Robot Hardware Market Forecast (1)

- Collaborative Robot Hardware Market Report (1)

- Collaborative Robot Hardware Market Research (1)

- Collaborative Robot Hardware Market Research Repor (1)

- ColorJet Printing (1)

- Colorectal Cancer Test (1)

- Combine Harvesters Industry (1)

- Combine Harvesters Report (1)

- Commercial Aircraft Landing Gear Market Report (1)

- Commercial Aircraft Landing Gear Market Study (1)

- Commercial Drone Camera Market (1)

- Commercial Drone Camera Market Size (1)

- Commercial Drone Camera Market Volume (1)

- Commercial Lighting as a Service Market (1)

- Commercial UAS Markem (1)

- Commercial UAV Market (1)

- Commercial UAV Market Share (1)

- Commercial Vehicle ADAS Market (1)

- Commercial Vehicle ADAS Market Research (1)

- Commercial Vehicle Market (1)

- Commercial Vehicles Market (1)

- Compatibility of 5G Networks (1)

- Compression Bandages Industry (1)

- Compression Bandages Market (1)

- Compression Bandages Report (1)

- Computed Tomography Industry (1)

- Computed Tomography Market (1)

- Computed Tomography Market Report (1)

- Computed Tomography Scans (1)

- Computer Aided Design (CAD) Market (1)

- Computer Aided Design Forecast (1)

- Computer Aided Design Growth (1)

- Computer Aided Design Industry (1)

- Computer Aided Design Industry Analysis (1)

- Computer Aided Design Market Research (1)

- Computer Aided Design Market Share (1)

- Computer Aided Design Report (1)

- Computer Aided Design Trends (1)

- Computer Aided Diagnostics (1)

- Computer Aided Diagnostics Market (1)

- Computer Aided Diagnostics Market Report (1)

- Computer Vision Technology Market for Agriculture (1)

- Constrained Application Protocol (1)

- Constrained Peptide Drugs (1)

- Constrained peptides (1)

- Construction Materials Market (1)

- Construction Sealants Market Report (1)

- Construction Sealants Market share (1)

- Construction Sustainable Materials Market (1)

- Consumer Electronics Show (1)

- Contact Layer Dressings Market (1)

- Continuous Fiber Composites Market analysis (1)

- Continuous Fiber Composites Market forecast (1)

- Continuous Fiber Composites Market growth (1)

- Continuous Fiber Composites Market report (1)

- Continuous Fiber Composites research (1)

- Continuous Fiber Composites trends (1)

- Continuous Glucose Monitoring System Market (1)

- Convertible Telepresence Robot Industry (1)

- Convertible Telepresence Robot Market (1)

- Convertible Telepresence Robot Report (1)

- Core Materials Industry (1)

- Core Materials Market (1)

- Core Materials Report (1)

- Coronavirus disease (1)

- Cost-effective Livestock Monitoring (1)

- Counter-UAV Industry (1)

- Counter-UAV Market (1)

- Counter-UAV Report (1)

- Crickets (1)

- Croatia (1)

- Cultured Meat Industry (1)

- Cultured Meat Market (1)

- Cultured Meat Report (1)

- Cyber Security Market (1)

- Cyber Security Market Research (1)

- Cybercriminals (1)

- Cybersecurity Trends (1)

- DAC Market (1)

- DNA Methylation Detection Technology Market (1)

- DNA/RNA Sample Extraction and Isolation Market (1)

- DNARNA Sample Extraction and Isolation Market (1)

- DRAM DIMM Industry (1)

- DRAM DIMM Market, (1)

- DRAM DIMM Report (1)

- DTC wellness (1)

- DTC wellness products (1)

- Data Center Power Infrastructure Market (1)

- Data Center Refrigerant Market (1)

- Data Center Solution (1)

- Data Management in Agriculture (1)

- Data Mining Software Solutions (1)

- Data Mining Software Solutions Market (1)

- Data Mining Software Solutions Market Report (1)

- Data and Services Market (1)

- Data on Fermented Foods (1)

- Decentralize Agriculture (1)

- DeepTechTalk (1)

- Defense Outlook Report (1)

- Dental Digital and Robotics Solutions Market (1)

- Dental Implants (1)

- Dental Implants Industry (1)

- Dental Implants Market (1)

- Dental Implants Report (1)

- Dental Infections Control Industry (1)

- Dental Infections Control Market (1)

- Dental Infections Control Market Report (1)

- Dental Medical Image Analytics Market (1)

- Dental Radiography (1)

- Dental Radiography Market (1)

- Dental Robotics Solutions Market (1)

- Dental radiographs (1)

- Desktop 3D Printer Market (1)

- Desktop 3D Printer Market Forecast (1)

- Desktop 3D Printer Market Research (1)

- Diagnostic Centers Medical Image market (1)

- Diagnostic Imaging Systems Market (1)

- Digital Diagnostics Industry (1)

- Digital Diagnostics Market (1)

- Digital Diagnostics Report (1)

- Digital Farm (1)

- Digital Forensic Technology (1)

- Digital Manufacturing (1)

- Digital PCR (1)

- Digital PCR technology (1)

- Digital Technologies (1)

- Digital health (1)

- Direct Air Capture Industry (1)

- Direct Air Capture Market (1)

- Direct Air Capture Report (1)

- Direct-to-Customer Wellness (1)

- Directed Energy Weapons (1)

- Drip Irrigation (1)

- Drone Application Map Tool Industry (1)

- Drone Application Map Tool Market (1)

- Drone Application Map Tool Report (1)

- Drone Camera Market (1)

- Drone Camera Market forecast (1)

- Drone Camera Market share (1)

- Drone Camera Market trends (1)

- Drone Webinar (1)

- Drones In Agriculture (1)

- Drones for Earth Observation (1)

- Drug Infusion Systems Market analysis (1)

- Drug Infusion Systems Market forecast (1)

- Drug Infusion Systems Market growth (1)

- Drug Infusion Systems Market share (1)

- Drug Infusion Systems Market trends (1)

- Drug Infusion Systems industry analysis (1)

- Drug Infusion Systems industry report (1)

- Drug Infusion Systems market value (1)

- Dry X-Ray Films (1)

- E cig (1)

- E cigarette ban (1)

- E cigarette market trend 2015 (1)

- E cigarette survey (1)

- E-cigarette Aftermarket Report (1)

- E-cigarette Vape Shop Aftermarket Trends (1)

- E-cigarette Vape Shop Market Study (1)

- E-liquid (1)

- E-liquid Market (1)

- E-liquid Market Analysis (1)

- E-liquid Market Research (1)

- E-liquid Report (1)

- ECG (1)

- ECG analysis (1)

- ECG monitoring (1)

- EED (1)

- EED Market (1)

- EED Market Growth (1)

- EED Market Size (1)

- EED Report (1)

- EU Green Deal (1)

- EU Green Deal 2050 (1)

- EV Business (1)

- EV Charging (1)

- EV Charging Infrastructure (1)

- EV Ecosystem (1)

- EV Shock Testing (1)

- EV Testing (1)

- EV Webinar (1)

- EV battery (1)

- EV efficiency (1)

- EV fast charging system market (1)

- EV market (1)

- Earth Observation Satellite (1)

- Earth Observation Satellites (1)

- Earth Observation Satellites Data and Services Mar (1)

- Earth observation (1)

- Earth observation drones market (1)

- Edge Analytics Market analysis (1)

- Edge Analytics Market forecast (1)

- Edge Analytics Market growth (1)

- Edge Analytics Market research report (1)

- Edge Data Center Market (1)

- Electric ATV and UTV (1)

- Electric ATV, UTV, and Golf Cart Industry (1)

- Electric ATV, UTV, and Golf Cart Market (1)

- Electric ATV, UTV, and Golf Cart Market Analysis (1)

- Electric ATV, UTV, and Golf Cart Market Research (1)

- Electric Caravans (1)

- Electric Farm Tractors Industry (1)

- Electric Farm Tractors Market (1)

- Electric Farm Tractors Market Report (1)

- Electric Farm Tractors Market Research (1)

- Electric Farm Tractors Market Size (1)

- Electric Stimulation Sensors (1)

- Electric Vehicle (EV) Battery Housing Market (1)

- Electric Vehicle Battery (1)

- Electric Vehicle Battery Cost Forecast (1)

- Electric Vehicle Battery market (1)

- Electric Vehicle Battery report (1)

- Electric Vehicle Bearings (1)

- Electric Vehicle Ecosystem (1)

- Electric Vehicle Fast Charging System Market Size (1)

- Electric Vehicle Sensor Industry (1)

- Electric Vehicle Sensor Market (1)

- Electric Vehicle Sensor Report (1)

- Electric Vehicle Virtual Prototyping (1)

- Electric Vehicle Virtual Prototyping Market (1)

- Electric Vehicle batteries (1)

- Electric Vehicles Battery Market analysis (1)

- Electric Vehicles Battery Market forecast (1)

- Electric Vehicles Battery Market growth (1)

- Electric Vehicles Battery Market share (1)

- Electric Vehicles Battery Market trends (1)

- Electric Vehicles Battery industry (1)

- Electric Vehicles Battery report (1)

- Electric Vehicles Forecast (1)

- Electric Vehicles Market (1)

- Electric Vehicles Market Research (1)

- Electric Vehicles Market Share (1)

- Electric Vehicles Market Trends (1)

- Electric and Hybrid Aircraft (1)

- Electrochemical Biosensor Technology (1)

- Electromagnetic waves (1)

- Electronic cigarette Market Analysis (1)

- Electronic cigarette Market Size (1)

- Electrophysiology Industry (1)

- Electrophysiology Market (1)

- Electrophysiology Report (1)

- Electrosurgical Devices Market (1)

- Electrosurgical Devices Market analysis (1)

- Electrosurgical Devices Market forecast (1)

- Electrosurgical Devices Market growth (1)

- Electrosurgical Devices Market keyplayer (1)

- Electrosurgical Devices Market report (1)

- Electrosurgical Devices Market trend (1)

- Electrosurgical Devices Market value (1)

- Electrosurgical Devices industry analysis (1)

- Emerging Mental Health, (1)

- Emerging Technologies (1)

- Emerging Trends inIoT in Oil and Gas Market (1)

- Endoscopy Procedure Volume Database (1)

- Endoscopy Procedure for SPDV (1)

- Energy (1)

- Energy Efficient Devices Market (1)

- Energy Efficient Devices Market Analysis (1)

- Energy Efficient Devices Market Study (1)

- Energy Efficient Glass Market (1)

- Energy Efficient Glass Market Forecast (1)

- Energy Efficient Glass Market Research (1)

- Energy Efficient Glass Market Trends (1)

- Energy Efficient Market (1)

- Energy Efficient Market Forecast (1)

- Energy Efficient Market Survey (1)

- Energy Sector (1)

- Energy Storage Market Forecast (1)

- Energy Storage Market Research (1)

- Energy Storage Market Size (1)

- Energy Storage Materials Industry (1)

- Energy Storage Materials Market (1)

- Energy Storage Materials Report (1)

- Enhanced Geothermal Systems Market (1)

- Enhanced Treatment Planning (1)

- Entertainment Robots Market Size (1)

- Environmental sustainability (1)

- Epigenetics Market (1)

- Europe Alternative Cathode Material Industry (1)

- Europe Alternative Cathode Material Market (1)

- Europe Alternative Cathode Material Report (1)

- Europe E-cigarette Aftermarket Forecast (1)

- Europe E-cigarette Aftermarket Research (1)

- Europe E-cigarette Vape Shop Market Analysis (1)

- Europe Electric Vehicle Aftermarket Industry (1)

- Europe Electric Vehicle Aftermarket Market (1)

- Europe Electric Vehicle Aftermarket Report (1)

- Europe Electric Vehicle Insulation Industry (1)

- Europe Electric Vehicle Insulation Market (1)

- Europe Electric Vehicle Insulation Report (1)

- Europe Livestock Monitoring & Management Marke (1)

- Europe Maritime Satellite Industry (1)

- Europe Maritime Satellite Market (1)

- Europe Maritime Satellite Report (1)

- Europe Sustainable Steel Market (1)

- Europe TJA Systems Market (1)

- Europe Traffic Jam Assist Systems Market (1)

- Europe automated sample preparation market (1)

- European Indoor Robots Market Size (1)

- European Union Green Deal (1)

- European Union Green Deal 2050 (1)

- Exoskeletons Market Analysis (1)

- Extraction of Circulating cfDNA (1)

- Eye Based Biometric Recognition Systems (1)

- FAA Remote ID (1)

- FHIR system (1)

- FIFA World Cup 2022 (1)

- FIFA World Cup Blog (1)

- Facial-Based Biometric Recognition Systems (1)

- Far-Field Wireless Charging (1)

- Farm Automation (1)

- Farm ERP Industry (1)

- Farm ERP Market (1)

- Farm ERP Report (1)

- Farm Equipment Industry (1)

- Farm Equipment Market (1)

- Farm Equipment Report (1)

- Farm Management Software & Services Market (1)

- Farm management systems (1)

- Farming Techniques (1)

- Fatal Digestive Disorders (1)

- Federal Aviation Administration (1)

- Fermented Feed Ingredient Market (1)

- Fermented Food & Ingredients Market (1)

- Fermented Food and Ingredients Market Research (1)

- Fermented Foods Forecast (1)

- Fermented Foods Industry (1)

- Fermented Foods Ingredients Market (1)

- Fermented Foods Market (1)

- Fermented Foods Trends (1)

- Fiber Composites Market share (1)

- Fibromyalgia Market (1)

- Fibromyalgia Market Outlook (1)

- FinFET Technology Market Growth (1)

- FinFET Technology Market Outlook (1)

- FinFET Technology Market Research Report (1)

- FinFET Technology Market Size (1)

- FinFET Technology Market Study (1)

- FinFET Technology Market Survey (1)

- FinFET Technology Market Trends (1)

- Fixed Biometric Systems (1)

- Fixed Wing Hybrid VTOL Market (1)

- Fixed Wing VTOL Aircraft Market (1)

- Fixed Wing VTOL Aircraft Market Research (1)

- Flame retardants (1)

- Flexible Heaters (1)

- Flexible printed electronic materials (1)

- Floating Data Center Market (1)

- Fluids (1)

- Food Industry (1)

- Food Manufacturing (1)

- Food Safety Testing System Market forecast (1)

- Food Safety Testing System Market research report (1)

- Food Safety Testing System Market share (1)

- Food Safety Testing System Market trends (1)

- Food Safety Testing System industry analysis (1)

- Food Security (1)

- Food Tech Market (1)

- Food Tech Market Forecast (1)

- Food Tech Market Research (1)

- Food Technology (1)

- Food Traceability Market (1)

- Food Traceability Market Forecast (1)

- Food Traceability Market Research (1)

- Food and beverages (1)

- Forensic Technologies (1)

- Forensic Technology Market (1)

- Forensic Technology Market Research (1)

- Forensic Technology Market Trends (1)

- Fuel Cell (1)

- Fuel Cell Market Report (1)

- Fuel Cell Technology (1)

- Fuel Cell Technology Market (1)

- Fuel Injection Market Research (1)

- Fuel Injection Market Study (1)

- Fuel Injection Systems Market Survey (1)

- Full Spectrum LED Grow Lights (1)

- Future of Green Energy (1)

- GERD Drugs and Devices Market (1)

- GERD Drugs and Devices Market Size (1)

- GERD Drugs market (1)

- GERD Market (1)

- GERD Market Study (1)

- GERD Therapy market (1)

- GERD Therapy market Survey (1)

- GIS-based solutions (1)

- GNSS (1)

- GPS (1)

- GPS in Farming (1)

- GRED (1)

- Gallium Nitride (1)

- Gallium Nitride Market (1)

- Games of Skill Market Analysis (1)

- Gaming Market (1)

- Gastroesophageal Reflux Disease Drug And Devices M (1)

- Gastroesophageal Reflux Disease Drug Market (1)

- Geely (1)

- Generative AI Market (1)

- Generative AI Market analysis (1)

- Generative AI Market report (1)

- Generative AI Market size (1)

- Genetic Disorders (1)

- Genetic Testing (1)

- Geospatial Imagery Analytics (1)

- Geospatial Imagery Analytics Industry (1)

- Geospatial Imagery Analytics Market (1)

- Geospatial Imagery Analytics Report (1)

- Germany Wire and Cable Industry (1)

- Germany Wire and Cable Market (1)

- Germany Wire and Cable Report (1)

- Glass Prefilled Syringes Market (1)

- Global 3D Printing Material Market (1)

- Global 3D Printing Materials Market (1)

- Global 3D Printing Materials Market Report (1)

- Global 3D Printing Plastic Market (1)

- Global 3D Printing Plastic Market Analysis (1)

- Global 3D Printing Plastic and Photopolymer Materi (1)

- Global 3D Printing Services Market (1)

- Global 3D Printing Software (1)

- Global 3D Printing Software & Services Market (1)

- Global 3D Printing Software Market (1)

- Global 3D printers industry analysis (1)

- Global 3D printers market forecast (1)

- Global 3D printers market size (1)

- Global 3D printers market trends (1)

- Global 3DP Market (1)

- Global 3DP Market Forecast (1)

- Global ADAS Commercial Vehicles Market (1)

- Global ADAS Commercial Vehicles Market Analysis (1)

- Global ADAS for Commercial Vehicles Market (1)

- Global AGV Market (1)

- Global AGV Market Size (1)

- Global AR Market (1)

- Global AR and VR Market (1)

- Global AR and VR Market Research (1)

- Global Advance Energy Storage and Fuel Cell Market (1)

- Global Advanced Driver Assistance System Market (1)

- Global Advanced Wound Care Market (1)

- Global Advanced Wound Care Market Trends (1)

- Global Agricultural Adjuvants Market (1)

- Global Agricultural Adjuvants Market Analysis (1)

- Global Agricultural Adjuvants Market Share (1)

- Global Agricultural Adjuvants Market Size (1)

- Global Agricultural Adjuvants Market Trends (1)

- Global Agricultural Films Market (1)

- Global Agricultural Films Market Report (1)

- Global Agricultural Robots Market (1)

- Global Agricultural Robots Market Forecast (1)

- Global Agricultural Robots Market Report (1)

- Global Agricultural Surfactants Market (1)

- Global Agricultural Surfactants Market Share (1)

- Global Agricultural Surfactants Market Size (1)

- Global Agriculture Drones and Robots Market (1)

- Global Agriculture Drones and Robots Market Size (1)

- Global Agrigenomics Market (1)

- Global Air Conditioning Market (1)

- Global Airborne Detection Systems (1)

- Global Airborne Detection Systems for Submarines M (1)

- Global Airborne LiDAR System Market (1)

- Global Americas Prefabricated Steel Building Marke (1)

- Global Aquaponics & Hydroponics Systems & (1)

- Global Artificial Organs Market (1)

- Global Augmented Reality Market Volume (1)

- Global Augmented Reality Market value (1)

- Global Augmented Reality and Mixed Reality Market (1)

- Global Auto-Injectors Market (1)

- Global Automated Guided Vehicle Market (1)

- Global Automated Guided Vehicle Market Forecast (1)

- Global Automated Guided Vehicle Market Report (1)

- Global Automated Guided Vehicle Market Survey (1)

- Global Automotive Actuators Market (1)

- Global Automotive Actuators Market Report (1)

- Global Automotive Adaptive Lighting Market (1)

- Global Automotive Adaptive Lighting Market Report (1)

- Global Automotive Aftermarket (1)

- Global Automotive Aftermarket Forecast (1)

- Global Automotive Aftermarket Report (1)

- Global Automotive Fuel Injection Systems Market (1)

- Global Automotive Infotainment Market (1)

- Global Automotive LiDAR Market (1)

- Global Automotive LiDAR Market Report (1)

- Global Automotive Navigation Market (1)

- Global Automotive Navigation Systems Market (1)

- Global Automotive Navigation Systems Market Report (1)

- Global Automotive Refinish Coatings Market (1)

- Global Automotive Sensors Market (1)

- Global Automotive Sensors Market Report (1)

- Global Automotive Telematics Industry analysis (1)

- Global Automotive Telematics Market analysis (1)

- Global Automotive Telematics Market forecast (1)

- Global Automotive Telematics Market growth (1)

- Global Automotive Telematics Market research repor (1)

- Global Automotive Telematics Market share (1)

- Global Automotive Telematics Market trends (1)

- Global Autonomous Vehicle Market (1)

- Global Avoid System Market (1)

- Global BEVs Market (1)

- Global Battery Market for Electric Vehicles (1)

- Global Big Data in Healthcare Market (1)

- Global Big Data in Healthcare Market Report (1)

- Global Big Data in Healthcare Market research repo (1)

- Global Biofuels Market (1)

- Global Biofuels Market Research (1)

- Global Biologics Drug Development (1)

- Global Biologics Drug Discovery Market (1)

- Global Biomaterials Market (1)

- Global Biomaterials Market Report (1)

- Global Bioprinting Market (1)

- Global Bioprinting Market Patent Analysis (1)

- Global Bioprinting Market Share by Application (1)

- Global Bioprinting Market Share by Region (1)

- Global Bioprinting Market Share by Technology (1)

- Global Bioprinting Market forecast (1)

- Global Bioprinting Market gorwth (1)

- Global Bioprinting Market report (1)

- Global Bioprinting Market research (1)

- Global Bioprinting Market research report (1)

- Global Bioprinting Market size (1)

- Global Bioprinting Market trends (1)

- Global Biorational Market (1)

- Global Biorational Product Market (1)

- Global Biorational Product Market Forecast (1)

- Global Biorational Product Market Report (1)

- Global Biosensor Market (1)

- Global Biosensors Market (1)

- Global Biosensors Market Report (1)

- Global Biosensors Market size (1)

- Global Blockchain Technology Market (1)

- Global Blockchain Technology Market Research (1)

- Global Building Energy Management System Market (1)

- Global Building Energy Management System Market Si (1)

- Global CAD Market (1)

- Global CAD Market Analysis (1)

- Global CGM Market (1)

- Global CGM System Market Report (1)

- Global CNT Market (1)

- Global CNT Market Analysis (1)

- Global Camera Market (1)

- Global Cancer Care (1)

- Global Cancer Imaging Systems Market (1)

- Global Cancer Immunotherapy Market (1)

- Global Carbon Nanotube Market (1)

- Global Carbon Nanotube Market Analysis (1)

- Global Carbon Nanotube Market Forecast (1)

- Global Carbon Nanotube Market Research (1)

- Global Carbon Nanotube Market Research Report (1)

- Global Cathode Materials Market (1)

- Global Cathode Materials Market Report (1)

- Global Cathode Materials Market Research (1)

- Global Cathode Materials Market by End-Users (1)

- Global Cathode Materials Market by Type (1)

- Global Cathode Materials Market by materials (1)

- Global Cathode Materials Player Share Analysis (1)

- Global Cell Free DNA Extraction and Isolation Mark (1)

- Global Cell Free DNA Isolation and Extraction Mark (1)

- Global Clinical Decision Support Systems (CDSS) Ma (1)

- Global Clinical Decision Support Systems Market (1)

- Global Clinical Decisions Support Systems Market (1)

- Global Cognitive Electronic Warfare System Market (1)

- Global Cognitive Electronic Warfare System Market (1)

- Global Cognitive Robotic Process Automation Market (1)

- Global Commercial Aircraft Landing Gear Market (1)

- Global Commercial UAV Market (1)

- Global Commercial Vehicle ADAS Market (1)

- Global Commercial Vehicle ADAS Market Report (1)

- Global Commercial Vehicles Telematics Systems Mark (1)

- Global Computer Aided Design Market (1)

- Global Computer Aided Design Market Report (1)

- Global Computer Aided Diagnostics Market (1)

- Global Computer Aided Diagnostics Market Research (1)

- Global Construction Sealants Market (1)

- Global Construction Sealants Market Report (1)

- Global Construction Sealants Market Research repor (1)

- Global Construction Sealants Market analysis (1)

- Global Construction Sealants Market growth (1)

- Global Construction Sealants Market share (1)

- Global Construction Sealants Market trends (1)

- Global Construction Sustainable Materials Market (1)

- Global Continuous Glucose Monitoring System Market (1)

- Global Conventional Contraceptive Market (1)

- Global Cyber Security Market (1)

- Global Cyber Security Market Analysis (1)

- Global Desktop 3D Printer Market (1)

- Global Desktop 3D Printer Market Report (1)

- Global Direct-to-Consumer Genetic Testin Market Sh (1)

- Global Direct-to-Consumer Genetic Testing (DTC-GT) (1)

- Global Direct-to-Consumer Genetic Testing Market (1)

- Global Drone Camera Market (1)

- Global Drone Camera Market Size (1)

- Global Drone Camera Market growth (1)

- Global Drone Camera Market report (1)

- Global Drone Camera Market research report (1)

- Global Drone Camera Market value (1)

- Global Drug Infusion Systems Market (1)

- Global Drug Infusion Systems Market report (1)

- Global Drug Infusion Systems Market research repor (1)

- Global E-cigarette Market (1)

- Global E-cigarette and T-Vapor Market (1)

- Global E-cigarette and T-Vapor Market forecast (1)

- Global EED Market (1)

- Global EV Battery Market Size (1)

- Global Edge Analytics Market (1)

- Global Edge Analytics Market Share (1)

- Global Edge Analytics Market report (1)

- Global Edge Analytics Market trends (1)

- Global Edge Analytics Solution Market By Region (1)

- Global Edge Analytics Solutions Market (1)

- Global Edge Analytics Solutions Market By Applicat (1)

- Global Electric Commercial Vehicles Market (1)

- Global Electric Vehicle Fast Charging System marke (1)

- Global Electric Vehicles Battery Market (1)

- Global Electric Vehicles Battery Market Size (1)

- Global Electric Vehicles Battery Market report (1)

- Global Electric Vehicles Market (1)

- Global Electric Vehicles Market Analysis and Forec (1)

- Global Electric Vehicles Market Volume (1)

- Global Electrosurgical Devices (1)

- Global Electrosurgical Devices Market (1)

- Global Electrosurgical Devices Market research (1)

- Global Emergency Contraceptive Market (1)

- Global Energy Efficient Devices Market (1)

- Global Energy Efficient Devices Market Research (1)

- Global Energy Efficient Devices Market Trends (1)

- Global Energy Efficient Glass Market (1)

- Global Energy Efficient Glass Market Analysis (1)

- Global Energy Efficient Glass Market Report (1)

- Global Environmental Biosensor Market (1)

- Global Exoskeleton Industry Size (1)

- Global Farm Management Software & Services Mar (1)